Top 7 Deal Sourcing Platforms for Venture Capital in 2025

Most deal-sourcing platforms for venture capital help you track the same companies everyone else is already looking at.

Or worse, they give you the wrong kind of data. It’s either too surface-level (or completely incorrect) to offer any real edge in competitive sourcing. Or it’s so detailed and complex that it actually slows you down during the early-stage research phase.

If you want to actually find startups that match your thesis before they announce funding, spot breakout signals early, and automate your sourcing workflow, you need a platform built for discovery with accurate data.

Let’s take a look at seven deal sourcing platforms that help VC investors find early-stage startups before anybody else.

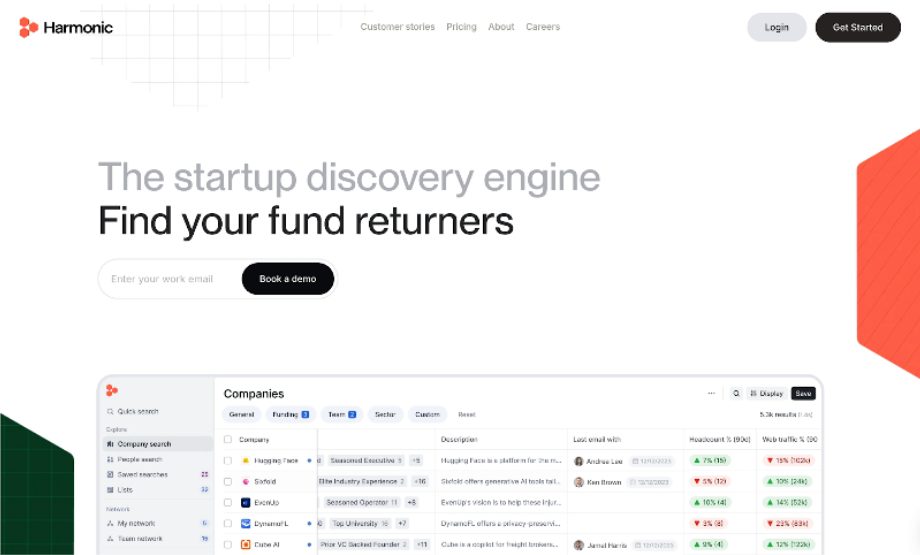

1. Harmonic AI: Best all-in-one platform for VC deal sourcing

Harmonic is a startup database and the most powerful discovery engine for early-stage venture capital teams. It gives you access to signals that predict breakout momentum, such as stealth emergence, hiring spikes, founder movement, detailed funding round information, and much more.

With Harmonic, you can:

- Build targeted searches for exactly the kinds of companies you’re looking for—like founders from OpenAI building in vertical SaaS, or AI startups hiring GTM teams before raising a Series A.

- Spot early signals that matter, including team growth, stealth domain activity, investor overlaps, and portfolio alumni launching new ventures.

- Run thesis-driven sourcing using filters for traction metrics, geography, founder background, and network adjacency.

- Automate your workflow with Scout, an AI agent that understands natural language queries (e.g., “AI for legal ops, pre-Series A, hiring in Europe”) and sends you qualified leads daily.

- Track companies and founders over time, set alerts, and push qualified leads directly into your CRM and Slack to keep your team in sync.

Harmonic has also developed its very own ChatGPT alternative that’s built directly into your deal sourcing platform. Except it’s even more intuitive for VCs because it’s purpose-built for startup research and trained on Harmonic’s proprietary startup database.

It brings together all of Harmonic’s core capabilities—search, filtering, enrichment, and insight generation—into one natural language interface. Instead of clicking through dropdowns or manually building lists, you can simply describe what you want to find, and Scout does all the research for you.

2. Crunchbase

Crunchbase is a lightweight startup database used by early-stage investors, founders, and operators to search and track private companies across various sectors. It’s best suited for quick company scans, where users want fast access to high-level data.

Some key Crunchbase features include:

- Basic filters for company stage, location, and funding rounds

- Public profiles with team info, milestones, and investor lists

- Saved searches and custom list building

- Recent funding alerts and press mentions

- Chrome extension for quick research in-browser

Crunchbase offers a free plan, with Crunchbase Pro starting at $49/month for individual users.

3. Dealroom

Dealroom is a global startup intelligence platform that specializes in ecosystem-level insights. It’s most useful for spotting vertical trends, identifying growing sectors, and sourcing startups by geography, market, or macro themes.

Dealroom features include:

- Market dashboards by sector, traction, and location

- Global database of startups, scaleups, and corporates

- Filters for stage, funding, team size, and impact tags

- Ecosystem heatmaps and investment trend analysis

- Integrations with Google Sheets, Airtable, and Slack

Dealroom plans start at $12,000/year for premium access. Full data access and additional user seats are available with a team ($20,000/year) or corporate ($40,000/year) plan.

4. Tracxn

Tracxn is a global startup research platform that provides structured access to company data in over 300 sectors. It’s designed for investors who want to explore specific markets, build comprehensive lists, and evaluate companies within defined verticals.

Key Tracxn features include:

- Pre-built company lists by industry, region, and maturity

- Dashboards that highlight sector trends and activity

- Filters for geography, team size, and business model

- Basic funding data and investor information

- Export tools for collaborative research and internal tracking

Tracxn offers a free plan or custom enterprise pricing based on usage, seats, and access level.

5. Grata

Grata is a search engine for private companies that helps investors identify founder-led businesses and source deals within niche markets. The platform is useful for thesis-driven sourcing, letting users target companies by keywords, employee count, GTM motion, or industry language.

Key Grata features include:

- Natural language search across millions of private companies

- Filters for founder-led, bootstrapped, or PE-backed businesses

- Enriched profiles with team size, business model, and web presence

- CRM sync and outreach tools for cold sourcing

- Market views to build and save thematic deal lists

Grata does not publicly disclose pricing, offering custom enterprise pricing based on usage and seats.

6. S&P Capital IQ Pro

Capital IQ is a financial data platform developed by S&P Global that gives investors access to detailed company financials, ownership structures, executive info, and sector-level benchmarks. It’s widely used by institutional investors, later-stage venture firms, and corporate finance teams that need to rigorously evaluate companies before deploying capital.

Key Capital IQ features include:

- Private company financials, revenue ranges, and profitability indicators

- Ownership and executive data with investor affiliations

- Peer comps, industry benchmarks, and public/private comparisons

- Excel plugin with robust modeling integrations

- M&A activity, transaction history, and deal screening

All pricing plans require custom licensing. Plans for VC teams typically start at $30K+/year.

7. Pitchbook

PitchBook is a private market database used by VCs, PE firms, and investment banks to analyze funding rounds, valuations, investor activity, and company financials. The platform is particularly valuable for pulling deal comps, understanding investor syndicates, and benchmarking financials across rounds or verticals.

PitchBook’s key features include:

- Funding round history with valuation and investor data

- Cap table insights and deal terms

- Public and private comparables

- Advanced filtering by industry, geography, and investor type

- Export tools for Excel and CRM sync

Interested users need to contact PitchBook directly for pricing information. Typically, an enterprise plan exceeds $100,000 for team-wide access.

Streamline Your Early-Stage VC Deal Sourcing

AI is transforming how early-stage investors discover and evaluate startups, turning what used to be a manual grind into a data-driven advantage.

Platforms like Harmonic.ai surface promising founders before they hit the radar, helping VCs act faster and smarter. By adopting AI-powered sourcing tools now, firms can future-proof their pipeline and stay ahead in an increasingly competitive venture landscape.

Source: Top 7 Deal Sourcing Platforms for Venture Capital in 2025